An important factor that is sometimes disregarded as eCommerce grows and reaches a worldwide audience as firms increase sales volumes is insurance. Cyberattacks, data breaches, product liability claims, and shipment problems are just a few of the dangers that eCommerce companies face, much like traditional firms. That’s when company insurance for eCommerce becomes crucial.We will discuss eCommerce business insurance in this in-depth guide, along with its definition, benefits, and methods of implementation. We will also evaluate many top insurers operating in India and around the world.

What is eCommerce Business Insurance?

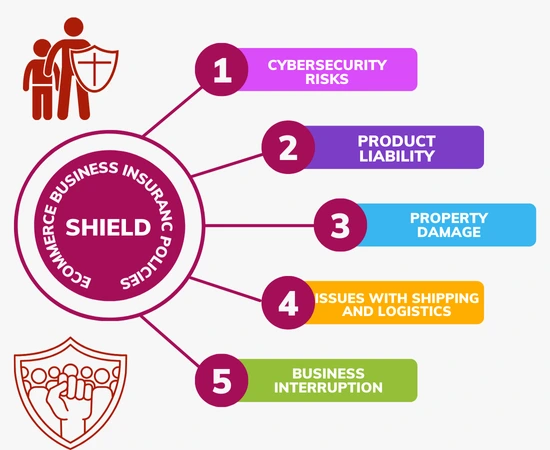

A policy (or collection of policies) called eCommerce business insurance is meant to shield internet companies from the particular hazards they encounter. Typically, the coverage consists of a number of safeguards that address:

- Cybersecurity Risks: Incidents involving data breaches, hacking, and lost consumer information may lead to legal action, penalties, and reputational damage.

- Product Liability: Expensive legal disputes may arise if a product sold by the eCommerce platform injures or harms a customer.

- Property Damage: This includes harm caused by fire, theft, natural catastrophes, or other events to the company’s tangible assets, such as offices or warehouses.

- Issues with Shipping and logistics: Insurance against lost or damaged items in transit.

- Business Interruption: Covers loss of income as a result of unplanned occurrences that stop operations, such as fires, cyberattacks, or natural disasters.

eCommerce business insurance, in contrast to traditional business insurance, is designed with these companies’ digital nature in mind and provides more extensive coverage for intangible assets like data, intellectual property, and digital operations.

Why is eCommerce Business Insurance Necessary?

- Defense Against Online Threats

One of the biggest concerns eCommerce businesses face is cyber threats. Data breaches and hacking attempts are quite likely as online transactions increase. Cyberattacks can do terrible harm, including the loss of customer data, interruptions to business operations, and even legal action. Insurance guards against these monetary losses and facilitates the management of the aftermath damage control procedure. - Liability for Products

There is always a chance that something will go wrong when selling tangible products. A faulty product, improper usage, or even faulty instructions could cause harm to the consumer. Product liability insurance makes sure that your company is shielded from lawsuits and losses resulting from these kinds of problems. - Dangers of Shipping

Shipments of items to clients are a part of every eCommerce firm. But items might get misplaced, pilfered, or harmed while traveling. Insurance for shipping and logistics helps cover lost items and can prevent a large financial loss for the company. - Business Reputation and Continuity

Imagine that during the peak holiday sales period, your eCommerce website experiences a catastrophic technical malfunction or cyberattack. Downtime could have a significant negative impact on your revenue. By paying for costs incurred during recovery, business interruption insurance guarantees business continuity and helps safeguard your revenue during these times. - Adherence to the Law

Certain regulatory restrictions exist in some countries or regions requiring online enterprises to carry specific insurance. This might include cyber liability insurance for businesses handling sensitive personal data or product liability insurance for online shops. - Safety of Workers

An eCommerce company’s workforce expands along with it. Making sure that workers are insured against potential job injuries is vital, particularly if you are in charge of an actual warehouse or office.

How to Get eCommerce Business Insurance?

Selecting the appropriate plans, evaluating your unique business requirements, and being aware of your risks are all necessary steps in obtaining the best eCommerce business insurance.

- Evaluate the Risks to Your Business

Start by examining the particular dangers that your company may encounter. Think about:

- What kind of goods do you sell? Are they foodstuffs or electronics, or are they other high-risk items?

- The quantity and type of your online transactions (Do you keep private information on file?)

- The areas to which you ship (international shipping may have extra hazards)

- Your dependence on third-party providers for services like payment processing, delivery, etc.

You can more effectively determine the type of insurance coverage you require by being aware of these dangers.

- Select Appropriate Coverage

Common insurance plans for eCommerce include:

- General Liability Insurance: Property damage, advertising injury, and bodily injury are all covered by general liability insurance.

- Insurance against product liability: Guards against lawsuits involving dangerous or faulty goods.

- Cyber Liability Insurance: Covers monetary losses resulting from data breaches, cyberattacks, and legal expenses.

- Insurance against business interruption: Provides financial support in the event of a brief closure of the company.

- Insurance for warehouses and property: shields your tangible assets from theft, fire, and other hazards.

Several policies may be required to cover various facets of your company. As an alternative, several insurance companies provide bundled packages designed specifically for eCommerce that combine several of these coverages.

- Assist a Specialist Trader

eCommerce business insurance brokers can assist you in locating the ideal combination of coverage at affordable prices. They are better able to evaluate your risks and direct you toward the most complete packages.

- Examine Insurance Companies

Examine the coverage, exclusions, restrictions, and premium prices of the insurance plans provided by different providers. It’s critical to consider not only the cost but also the scope of coverage and the insurer’s reputation for effective claim handling.

- Regularly Reevaluate

Over time, your eCommerce company will change and grow—whether that means entering new markets, introducing new product lines, or boosting sales. It’s critical to periodically review your insurance requirements to make sure your policies continue to offer sufficient coverage as your company expands.

Leading eCommerce Business Insurance Providers in India

The following are some of the leading eCommerce Business Insurance provider companies in India that provide customized plans for online retailers:

- HDFC ERGO

For eCommerce companies, HDFC ERGO provides extensive eCommerce business insurance options that include product liability and cyber protection. Their solutions are well-known for being adaptable and appropriate for both small and large businesses. - AIG Tata

Tata AIG offers property, cyber, and product liability insurance that may be customized for e-commerce platforms. They also provide a variety of eCommerce business insurance plans, which is crucial for internet merchants. - Allianz Bajaj

Well-known insurance provider Bajaj Allianz provides business continuity, general liability, and cyber protection plans. Their cyber security insurance is especially robust for eCommerce sites with large transaction volumes. - Lombard ICICI

Insurance for eCommerce companies is provided by ICICI Lombard, which specializes in cyber and product liability. Their handling of claims and customer service are frequently cited as their main advantages.

Leading eCommerce Business Insurance Providers Globally

These eCommerce Business Insurance providers are well respected worldwide for their coverage of e-commerce enterprises:

- Chubb

Leading provider of complete coverage for cyberattacks, data breaches, and digital threats worldwide is Chubb. For eCommerce businesses, they also provide business interruption and product liability insurance. - Hiscox

Specialized eCommerce business insurance plans from Hiscox cover professional liability, product liability, and cyber liability. Because of their affordability and flexibility, small and medium-sized eCommerce enterprises favor their programs. - Switzerland

Online merchants may create company insurance policies from Zurich Insurance, which cover anything from data protection and intellectual property conflicts to shipping concerns. - London’s Lloyd’s

As a leader in cyber insurance, Lloyd’s offers customized eCommerce Business Insurance plans to eCommerce companies that cover risks including data breaches, cybercrime, and international shipping.

In summary

The hazards are as great as the rewards in the quick-paced world of eCommerce. eCommerce business insurance is essential to long-term success since it protects against litigation linked to products, cyber risks, and logistical issues. You can make sure that your internet business is safeguarded against unforeseen events by being aware of the particular risks you face and collaborating with insurance specialists.

Purchasing the appropriate insurance plans gives you piece of mind in addition to cash security, enabling you to concentrate on confidently expanding your company. There are now specialized eCommerce Business Insurance alternatives to match the various needs of eCommerce enterprises, regardless of whether you’re headquartered in India or operate internationally.

You can successfully navigate the world of eCommerce business insurance with the help of this guide, safeguarding your company from potential threats and optimizing growth opportunities.

What does eCommerce business insurance cover?

Typical coverage for eCommerce business insurance includes:

Risks associated with cybersecurity: defense against fraud, hacking, and data breaches.

Product liability: Pays for losses and court costs in the event that a product hurts a consumer.

Business interruption insurance covers income loss in the event that operations are suspended as a result of cyberattacks or natural disasters.

Concerns with shipping: Insurance against lost or damaged items in transit.

Is eCommerce business insurance mandatory?

eCommerce business insurance is not legally required in most places, but in some cases, such as when handling sensitive data or selling potentially dangerous products, you may need to obtain other types of insurance, such as cyber or product liability insurance, in order to abide by rules or fulfill contractual obligations.

How do I choose the right insurance policy for my eCommerce business?

First, evaluate the risks that your company faces (such as shipping problems, product safety, and cyber attacks). To compare coverage, speak with an insurance broker with expertise in eCommerce business insurance. Seek coverage for business disruption, cyber liability, product liability, and general liability.